Landing pages for financial services

Maximize lead generation in finance with our conversion-focused landing pages. We’ve collaborated with renowned financial service providers and corporates.

What to expect

Find more details about the knowledge, data analytic expertise, industry experience, conversion optimization skills, and UX design capabilities of financial services

landing page experts.

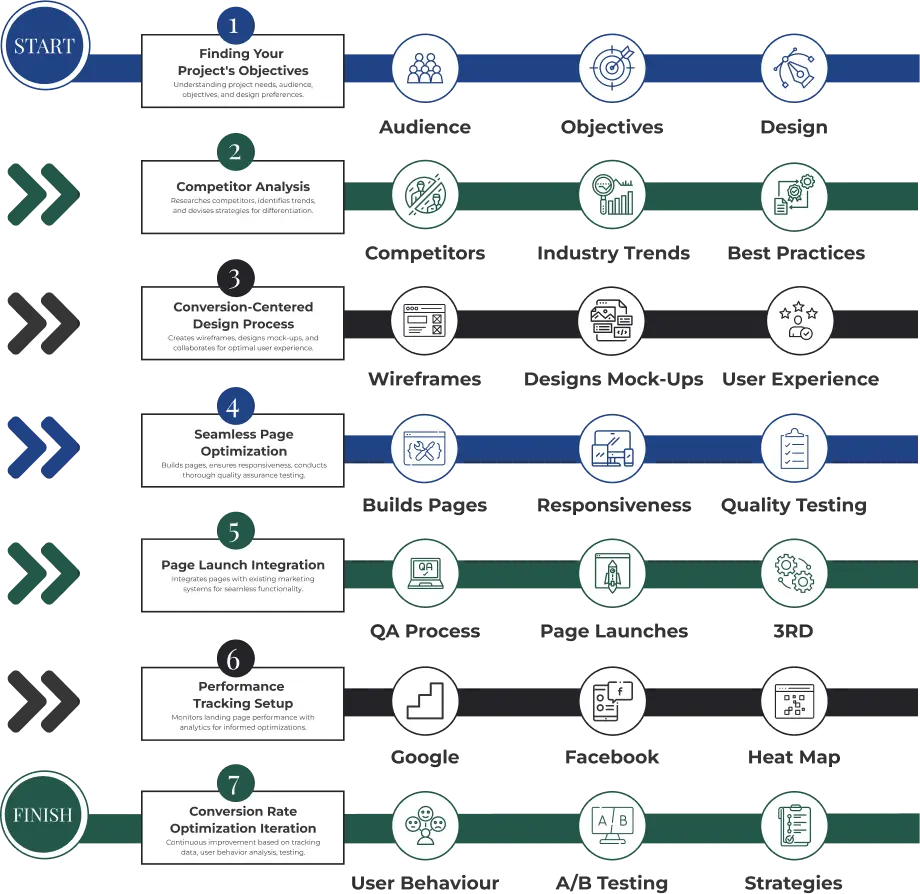

Conversion optimization

They focus on boosting conversion rates to encourage visitors to take desired actions.

Industry knowledge

They excel in the financial sector, understanding its unique challenges and regulations to shape landing page design and messaging effectively.

Data analysis

They use data insights to refine and optimize landing pages, meeting financial service goals.

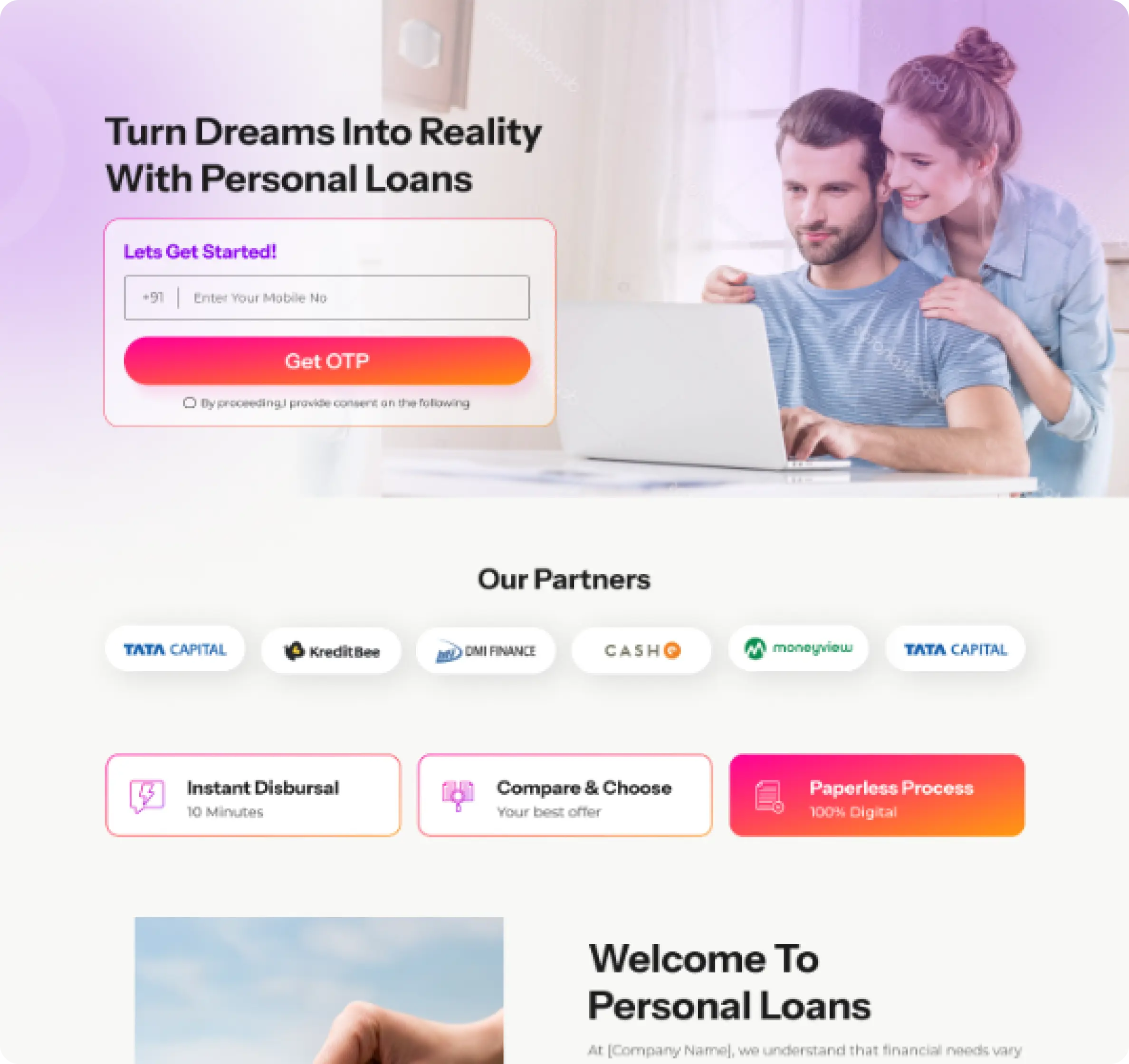

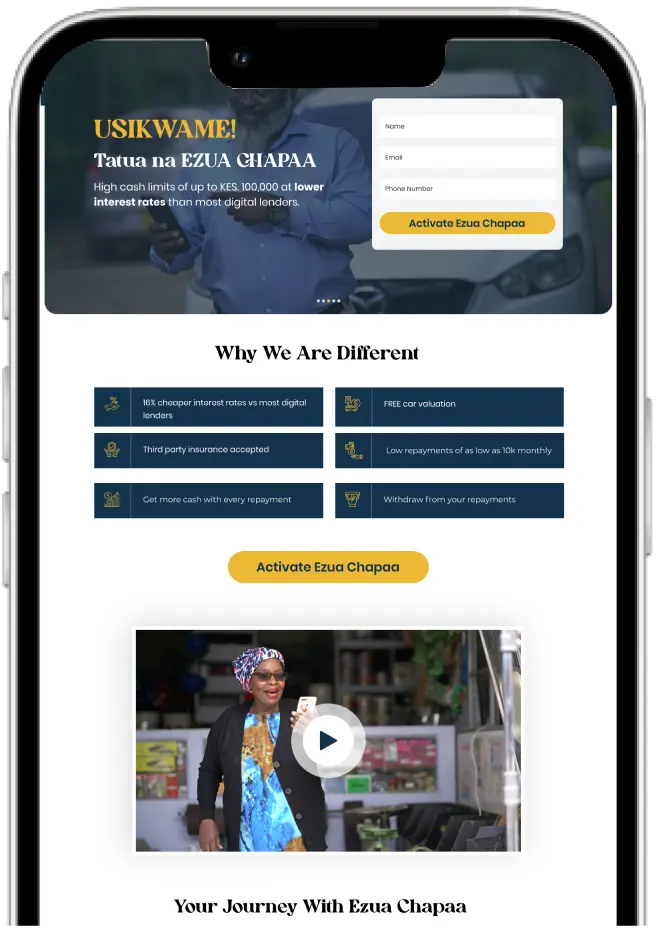

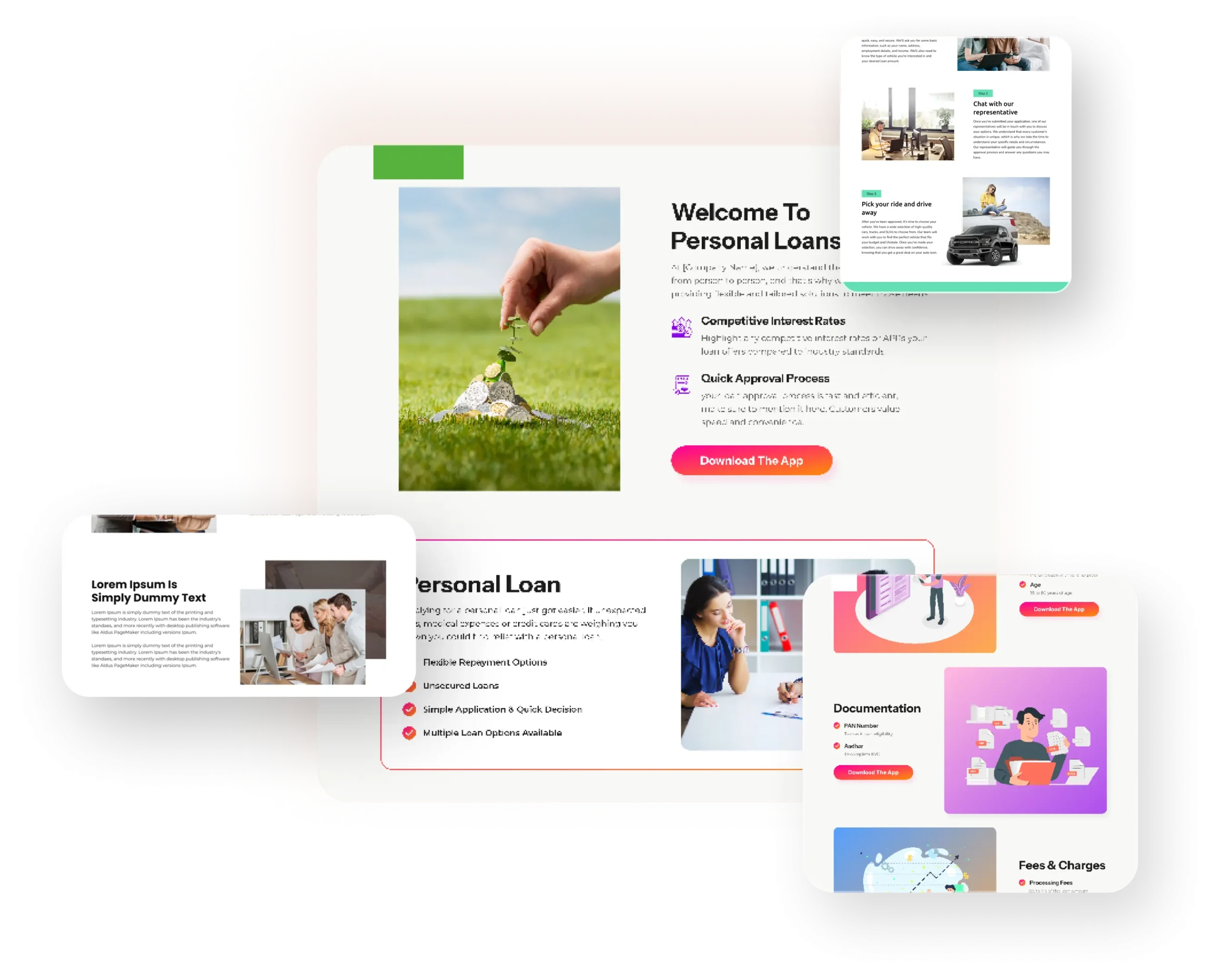

Check out our recent loan landing page projects below

Types of landing pages

Click-through

Our loan service lead generation pages are specifically crafted to gather visitor information effectively through a user-friendly form. This allows us to promptly follow up and provide personalized assistance based on their needs.

Visitors are incentivized with discounts, free trials, gifts, e-books, webinar access, consultations, contest entries, or exclusive product updates, enhancing engagement and facilitating easy connections with our loan services.

Lead generation

Click-through pages serve as a friendly introduction to our loan services, providing visitors with a preview of what we offer before guiding them deeper into the sales journey.

This approach is akin to warming up potential customers, gradually leading them towards taking the next step in exploring our products and services.

Our trusted approach

At SsanjeevT, we guarantee effective delivery of high-converting landing pages through our structured approach, consisting of the following steps.

Every loan landing page comes with these essential components

- Engaging headline

- User-friendly form

- Social proof

- A/B testing

- Benefits highlight

- Mobile optimization

- Cross browser compatibility

- FAQ section

- Clear call-to-action

- Clear navigation

- Analytics integration

- SEO optimization

Conversion expert: strategies for maximum result

Optimize loan leads with tailored financial landing pages, expert assistance, and comprehensive competitor analysis for

competitive advantage.

- Increase leads with customized landing pages

- Get help from expert conversion specialists

- Beat competitors with detailed analysis

- Boost results with data-driven optimization.

Frequently asked questions

What types of loans do you offer, and what are the eligibility criteria?

We offer a variety of loan options tailored to meet your specific needs, including personal loans, home loans, auto loans, and business loans. Eligibility criteria may vary depending on the type of loan but typically include factors such as credit score, income stability, employment history, and debt-to-income ratio.

How long does the loan approval process typically take?

The loan approval process can vary depending on various factors, including the type of loan, the lender’s internal processes, and the completeness of your application. Generally, approval times range from a few days to a few weeks, with some lenders offering expedited or same-day approval options for qualified applicants.

What documentation is required to apply for a loan?

The documentation required for a loan application typically includes proof of identity (such as a driver’s license or passport), proof of income (such as pay stubs or tax returns), proof of residence (such as utility bills or lease agreements), and any additional documents specific to the type of loan you’re applying for.

Can I apply for a loan online, and what information do I need to provide?

Yes, many lenders offer online loan application portals for added convenience. To apply online, you’ll need to provide personal information such as your name, address, date of birth, social security number, employment details, income verification, and details about the loan amount and purpose.

What are the interest rates and repayment terms for your loans?

Interest rates and repayment terms vary depending on the type of loan, current market conditions, and your creditworthiness. Interest rates may be fixed or variable, and repayment terms typically range from a few months to several years. We’ll provide you with a clear breakdown of rates and terms before you commit to the loan.

Are there any additional fees or charges associated with the loan?

Some loans may come with additional fees or charges, such as origination fees, closing costs, or prepayment penalties. We’ll disclose all charges upfront, so you know exactly what to expect and can make an informed decision.

How do you ensure the security and confidentiality of my personal information?

We take the security and confidentiality of your personal information seriously and adhere to strict privacy policies and industry standards. Our online application portals use encryption and other security measures to protect your data, and we never share your information with third parties without your consent.

What happens if I miss a loan payment or need to adjust my repayment schedule?

If you miss a loan payment or encounter financial difficulties, it’s important to contact us as soon as possible to discuss your options. We may be able to offer temporary payment arrangements, deferments, or other solutions to help you manage your repayment obligations effectively.

Do you offer options for refinancing or consolidating existing loans?

Yes, we offer refinancing and loan consolidation options for qualified borrowers looking to lower their interest rates, reduce their monthly payments, or simplify their debt management. Our loan specialists can help you explore your options and determine the best solution for your financial situation.

How can I contact customer support for assistance with my loan application or inquiries?

Our customer support team is available to assist you with any questions or concerns you may have about your loan application, repayment terms, or account management. You can reach us by phone, email, or through our online chat support system during business hours.

Get more leads with a high-converting loan landing page

Click the button below to leave us a message to discuss your next landing page or conversion project